* Subject to terms, conditions, and availability.

Introduction

Equisource Holdings Corp, owner of over $100M in Florida beach vacation rentals, is now offering stock to the public.

With income growth that would have qualified for the Inc. 5000 every year since 2021 and asset growth that has far outpaced the S&P 500 every year since our inception, Equisource is one of America’s fastest-growing vacation rental companies.

Invest early in our Pre-IPO before our planned exchange listing in 2026.

And did we mention that qualifying investors in our 100% real estate backed stock receive a stay at one of our luxury beach homes for free?

89% average annual growth since 2017 far outpaced the S&P 500

Revenue growth that was eligible for the Inc 5000 list of fastest growing companies every year since 2021

Backed by 100M+ in Florida vacation homes in prime locations

Bonus: Investors of $50,000 or more stay free in one of our stunning beach homes*

Free stay subject to investment minimums and eligibility. Terms apply.

Pre-IPO opportunity. Stock liquidity. Real estate security.

Asset Growth

From 2018 to 2024, Equisource’s average annual asset growth—expected to be the primary driver of stock’s price per share—has been 109.87%. This performance significantly exceeds the DJIA and S&P 500 over the same period.

Short Term Rental Revenue Growth

Verification Documents:

- Click revenue to view underlying verification documents.

From 2018 to 2024, Equisource has achieved average annual revenue growth of 104.46%. Although we didn’t apply, this growth rate would have qualified for the Inc 5000 list of America’s fastest growing private companies every year since 2021.

Our Numbers

New Construction ROI Track Record

Verification Documents:

- Click appraisal value to view appraisal.

- Click land amount to view public record of land cost.

- Click construction amount to view verification of costs.

- Click listing picture to view property listing/photographs.

| Photo/Link | Development Summary |

|---|---|

78 Cote D'Azur Dr

Santa Rosa Beach, FL 32459 |

78 Cote D'Azur Dr Santa Rosa Beach, FL 32459

Appraisal:

$3,300,000

Land Cost:

- $650,000

Construction Cost:

Equity Gain:

$1,104,034

ROI:

50.28%

Completed:

08/02/2023

|

65 Tarpon St

Destin, FL 32541 |

65 Tarpon St Destin, FL 32541

Appraisal:

$3,800,000

Land Cost:

Construction Cost:

Equity Gain:

$1,454,774

ROI:

62.03%

Completed:

08/16/2023

|

4451 Luke Ave

Destin, FL 32541 |

4451 Luke Ave Destin, FL 32541

Appraisal:

$3,550,000

Land Cost:

- $703,000

Construction Cost:

Equity Gain:

$1,698,528

ROI:

91.74%

Completed:

03/11/2024

|

103 Hollywood St

Miramar Beach, FL 32550 |

103 Hollywood St Miramar Beach, FL 32550

Appraisal:

$3,500,000

Land Cost:

- $790,000

Construction Cost:

Equity Gain:

$1,564,223

ROI:

80.81%

Completed:

04/03/2024

|

74 Pompano

Destin, FL 32541 |

74 Pompano Destin, FL 32541

Appraisal:

$2,750,000

Land Cost:

- $715,000

Construction Cost:

-

$903,780

Equity Gain:

$1,131,220

ROI:

69.88%

Completed:

05/29/2024

|

4553 Luke

Destin, FL 32541 |

4553 Luke Destin, FL 32541

Appraisal:

$3,450,000

Land Cost:

- $850,000

Construction Cost:

Equity Gain:

$1,529,649

ROI:

79.65%

Completed:

07/19/2024

|

43 Sandy Dunes Cir

Miramar Beach, FL 32550 |

43 Sandy Dunes Cir Miramar Beach, FL 32550

Appraisal:

$3,450,000

Land Cost:

- $700,000

Construction Cost:

Equity Gain:

$1,504,751

ROI:

77.36%

Completed:

09/25/2024

|

36 N Gulf Dr

Santa Rosa Beach, FL 32459 |

36 N Gulf Dr Santa Rosa Beach, FL 32459

Appraisal:

$3,650,000

Land Cost:

- $760,000

Construction Cost:

Equity Gain:

$1,818,359

ROI:

99.27%

Completed:

12/04/2024

|

59 Marthas Lane

Santa Rosa Beach, FL 32459 |

59 Marthas Lane Santa Rosa Beach, FL 32459

Appraisal:

$4,000,000

Land Cost:

- $840,000

Construction Cost:

Equity Gain:

$1,895,646

ROI:

90.08%

Completed:

04/30/2025

|

6508 W County Hwy 30a

Santa Rosa Beach, FL 32459 |

6508 W County Hwy 30a Santa Rosa Beach, FL 32459

Appraisal:

$4,200,000

Land Cost:

- $620,000

Construction Cost:

Equity Gain:

$2,224,186

ROI:

112.57%

Completed:

07/15/2025

|

, |

,

Appraisal:

$3,100,000

Land Cost:

- $882,000

Construction Cost:

Equity Gain:

$1,154,164

ROI:

59.31%

Completed:

N/A

|

, |

,

Appraisal:

$3,200,000

Land Cost:

Construction Cost:

-

$996,430

Equity Gain:

$1,003,570

ROI:

45.69%

Completed:

N/A

|

, |

,

Appraisal:

$3,300,000

Land Cost:

- $650,000

Construction Cost:

Equity Gain:

$1,180,147

ROI:

55.67%

Completed:

N/A

|

, |

,

Appraisal:

$2,750,000

Land Cost:

- $505,000

Construction Cost:

Equity Gain:

$1,186,703

ROI:

75.91%

Completed:

N/A

|

, |

,

Appraisal:

$3,600,000

Land Cost:

- $650,000

Construction Cost:

-

$940,117

Equity Gain:

$2,009,883

ROI:

126.40%

Completed:

N/A

|

, |

,

Appraisal:

$3,300,000

Land Cost:

- $505,000

Construction Cost:

-

$897,755

Equity Gain:

$1,897,245

ROI:

135.25%

Completed:

N/A

|

, |

,

Appraisal:

$3,900,000

Land Cost:

- $760,000

Construction Cost:

Equity Gain:

$2,122,063

ROI:

119.36%

Completed:

N/A

|

, |

,

Appraisal:

$3,650,000

Land Cost:

- $760,000

Construction Cost:

Equity Gain:

$1,776,762

ROI:

94.85%

Completed:

N/A

|

, |

,

Appraisal:

$3,800,000

Land Cost:

- $690,000

Construction Cost:

Equity Gain:

$1,869,547

ROI:

96.84%

Completed:

N/A

|

, |

,

Appraisal:

$3,150,000

Land Cost:

- $850,000

Construction Cost:

Equity Gain:

$1,149,252

ROI:

57.44%

Completed:

N/A

|

, |

,

Appraisal:

$3,465,000

Land Cost:

- $450,000

Construction Cost:

Equity Gain:

$1,735,371

ROI:

100.33%

Completed:

N/A

|

, |

,

Appraisal:

$4,200,000

Land Cost:

- $600,000

Construction Cost:

Equity Gain:

$2,202,313

ROI:

110.24%

Completed:

N/A

|

, |

,

Appraisal:

$3,500,000

Land Cost:

- $210,000

Construction Cost:

Equity Gain:

$2,235,857

ROI:

176.87%

Completed:

N/A

|

| Total |

Appraisal: $80,565,000

Land:

- $16,440,000

Construction:

- $26,676,753

Equity Gain: $37,448,247

ROI: 86.85%

|

| Average |

Appraisal: $3,502,826

Land:

- $714,783

Construction:

- $1,159,859

Equity Gain: $1,628,185

ROI:86.85%

|

Since 2021, Equisource has built $80,565,000 worth of new short-term beach rental properties that are held in its portfolio. These projects have generated an average equity gain of $1,628,185 per build for a total equity gain of $37,448,247. This represents an average ROI of 86.85%, which is typically achieved within a 12-month timeframe.

Vacation Rental Net Asset Value

Verification Documents:

- Click property name to view property listing.

- Click appraisal value amount to view appraisal.

| Property | Appraisal Value | Mortgage Balance | Equity / Net Asset Value |

|---|---|---|---|

| Aqua | $2,100,000 | $1,499,999 | $600,001 |

| Aviary | $4,000,000 | $2,758,629 | $1,241,371 |

| Epic | $2,500,000 | $1,176,649 | $1,323,351 |

| Flamingo | $2,750,000 | $1,972,908 | $777,092 |

| Freestyle | $1,750,000 | $1,312,500 | $437,500 |

| Harmony | $4,100,000 | $2,987,717 | $1,112,283 |

| Horizon | $3,300,000 | $2,350,993 | $949,007 |

| Iris | $3,550,000 | $2,340,428 | $1,209,572 |

| Mariner | $3,500,000 | $2,367,962 | $1,132,038 |

| Seafoam | $1,340,000 | $935,029 | $404,971 |

| Seaspray | $3,450,000 | $2,428,795 | $1,021,205 |

| Shenanigans | $2,250,000 | $1,388,885 | $861,115 |

| Splash | $2,550,000 | $1,836,680 | $713,320 |

| Sunbeam | $3,450,000 | $161,771 | $3,288,229 |

| Symphony | $3,650,000 | $2,711,386 | $938,614 |

| Vibe | $2,700,000 | $1,490,000 | $1,210,000 |

| Vista | $3,800,000 | $2,797,834 | $1,002,166 |

| Total : Pre-money | $50,740,000 | $32,518,165 | $18,221,835 |

| Total : Post-money | $50,740,000 | $-37,481,835 | $88,221,835 |

Equisource currently owns and operates $50,740,000 in tax-advantaged, appreciating, cash-flowing short-term rentals. Proceeds from this offering will be used to retire $32,518,165 in debt, immediately increasing free cash flow—capital that will be reinvested into our high-ROI new construction pipeline, creating a compounding cycle of equity growth and reinvestment.

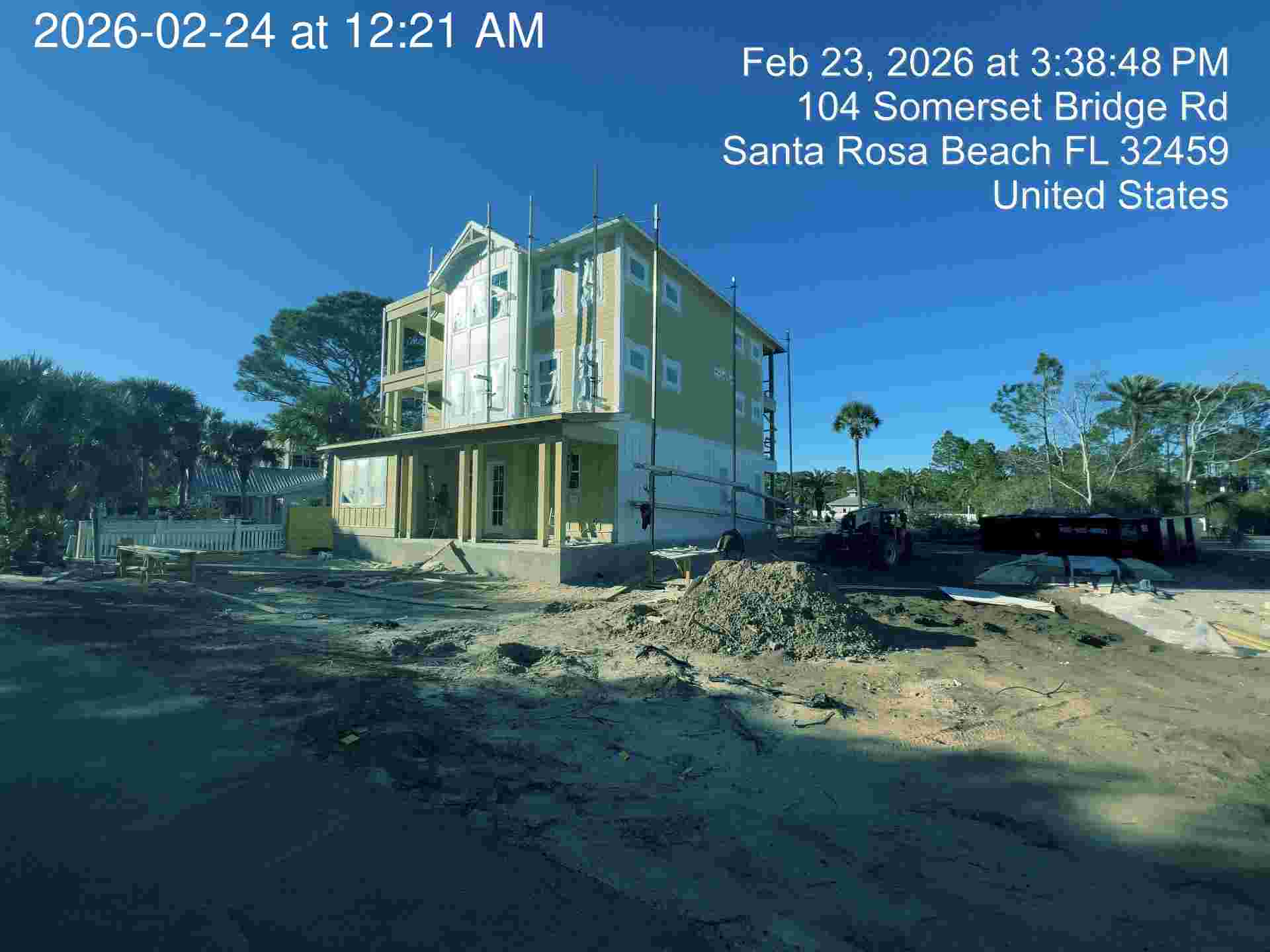

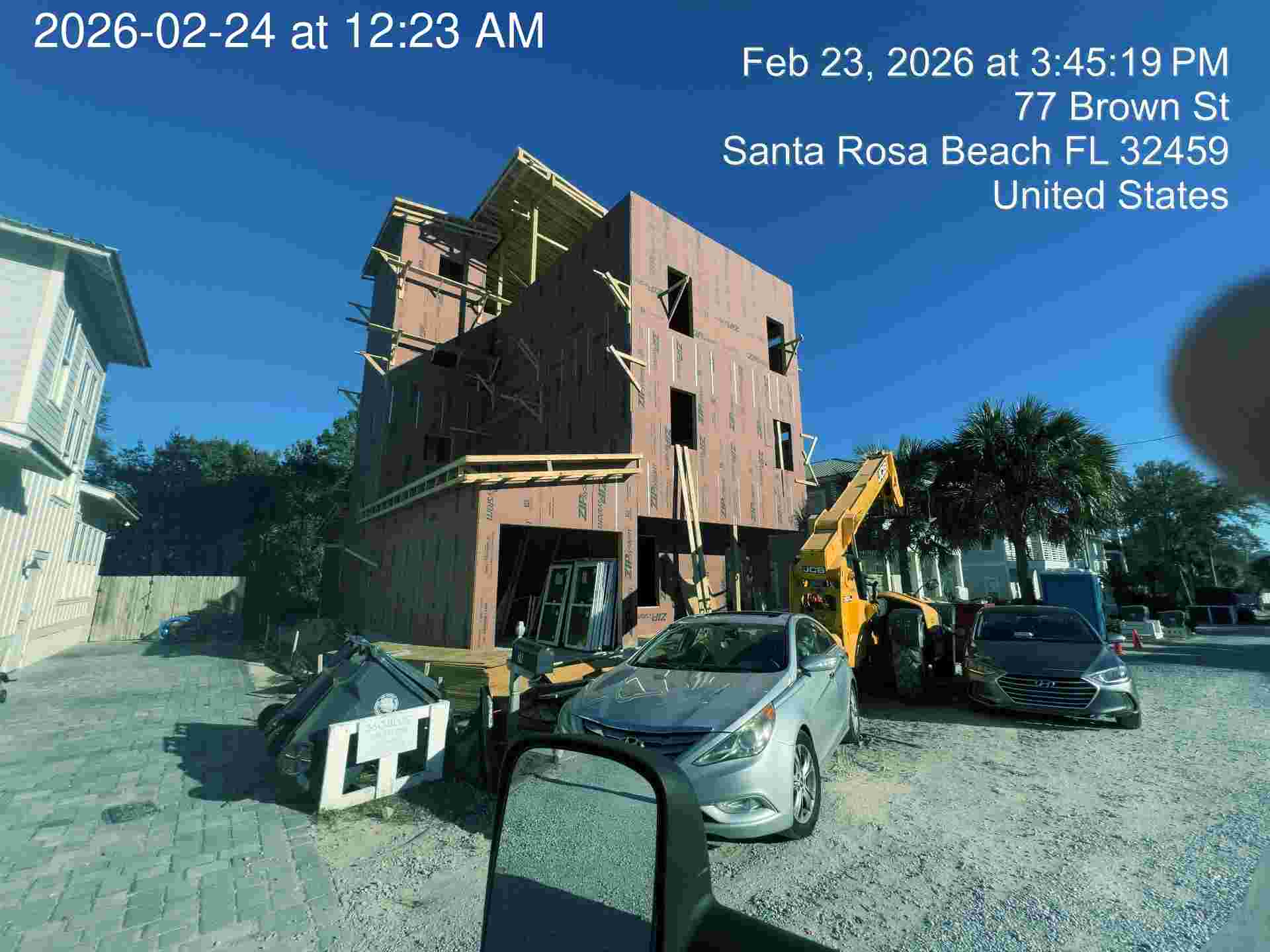

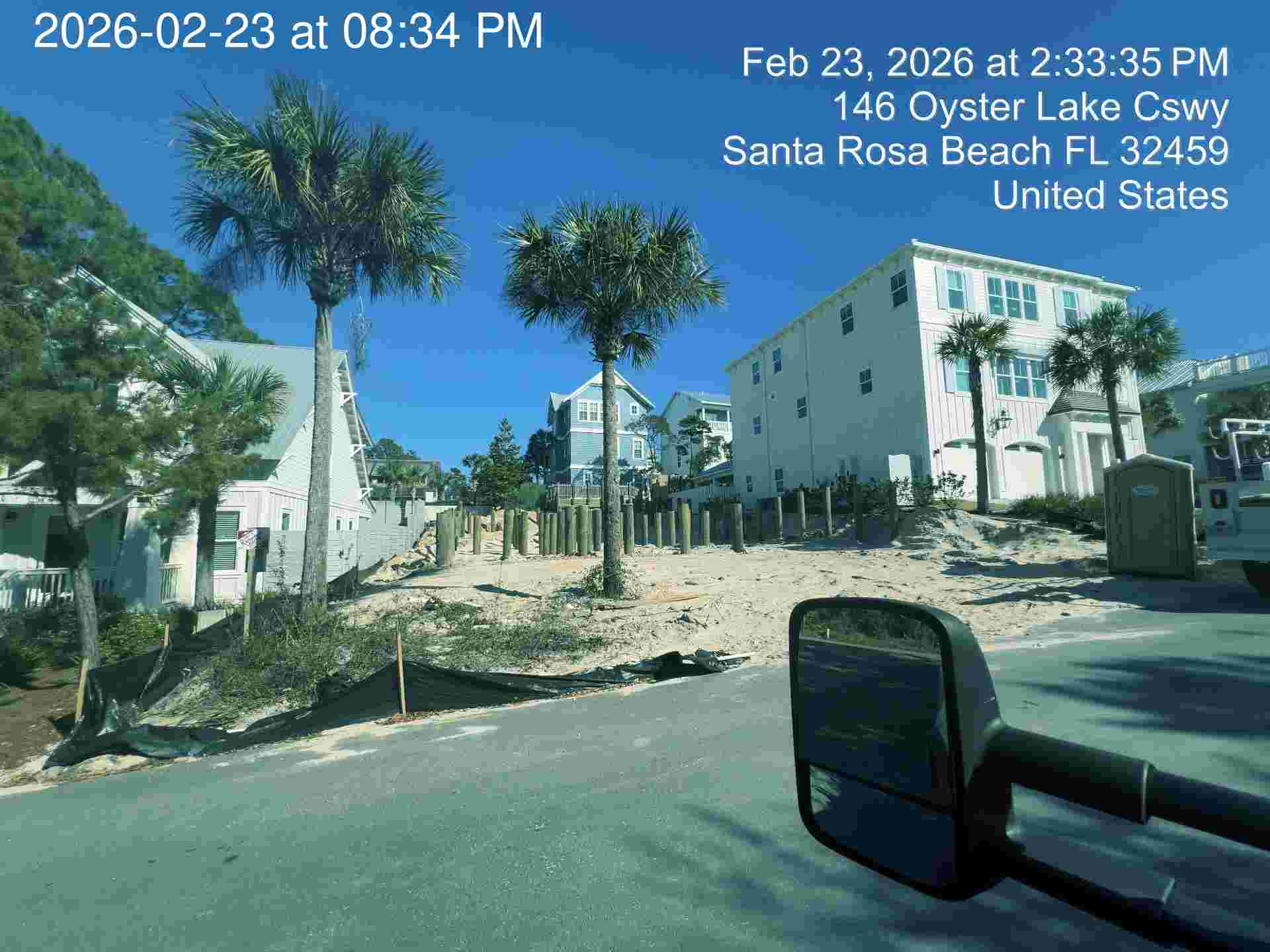

Current Projects

Verification Documents:

- Click land amount to view public record of land cost.

- Click construction cost amount to view construction bid.

- Click picture to view weekly construction progress pictures.

| Photo/Link | Development Summary Projections |

|---|---|

|

Lot 26 Spotted Dolphin, Santa Rosa Beach FL 32541

|

Lot 26 Spotted Dolphin, Santa Rosa Beach FL 32541

Projected Appraisal:

$3,600,000

Land Cost:

-

$485,000

Construction Costs:

Projected Equity Gain:

$1,848,047

ROI:

105.48%

Projected Increase in Assets:

7.09%

Start Date: 07/10/2025

|

|

Lot 4 Elm, Santa Rosa Beach FL 32459

|

Lot 4 Elm, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,600,000

Land Cost:

-

$585,000

Construction Costs:

Projected Equity Gain:

$1,610,469

ROI:

80.95%

Projected Increase in Assets:

7.09%

Start Date: 07/15/2025

|

|

Lot 8 Spotted Dolphin, Santa Rosa Beach FL 32459

|

Lot 8 Spotted Dolphin, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,600,000

Land Cost:

-

$450,000

Construction Costs:

Projected Equity Gain:

$1,932,019

ROI:

115.83%

Projected Increase in Assets:

7.09%

Start Date: 07/23/2025

|

|

Lot 7 Montigo, Santa Rosa Beach, FL 32459

|

Lot 7 Montigo, Santa Rosa Beach, FL 32459

Projected Appraisal:

$3,600,000

Land Cost:

-

$475,000

Construction Costs:

Projected Equity Gain:

$1,780,247

ROI:

97.83%

Projected Increase in Assets:

7.09%

Start Date: 10/17/2025

|

|

Lot 8 Montigo, Santa Rosa Beach, FL 32459

|

Lot 8 Montigo, Santa Rosa Beach, FL 32459

Projected Appraisal:

$3,600,000

Land Cost:

-

$475,000

Construction Costs:

Projected Equity Gain:

$1,780,247

ROI:

97.83%

Projected Increase in Assets:

7.09%

Start Date: 10/17/2025

|

|

50 Old Mill, Santa Rosa Beach, FL 32459

|

50 Old Mill, Santa Rosa Beach, FL 32459

Projected Appraisal:

$3,800,000

Land Cost:

-

$795,000

Construction Costs:

Projected Equity Gain:

$1,633,614

ROI:

75.41%

Projected Increase in Assets:

7.49%

Start Date: 10/24/2025

|

|

TBD Brown Ave, Santa Rosa Beach FL 32459

|

TBD Brown Ave, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,500,000

Land Cost:

-

$530,000

Construction Costs:

Projected Equity Gain:

$1,722,325

ROI:

96.89%

Projected Increase in Assets:

6.90%

Start Date: 11/12/2025

|

|

Lot 14 Hillcrest, Santa Rosa Beach FL 32459

|

Lot 14 Hillcrest, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,500,000

Land Cost:

-

$475,000

Construction Costs:

Projected Equity Gain:

$1,627,441

ROI:

86.91%

Projected Increase in Assets:

6.90%

Start Date: 01/06/2026

|

|

Lot 2 Marth's Lane, Santa Rosa Beach FL 32459

|

Lot 2 Marth's Lane, Santa Rosa Beach FL 32459

Projected Appraisal:

$4,000,000

Land Cost:

-

$750,000

Construction Costs:

Projected Equity Gain:

$1,806,765

ROI:

82.38%

Projected Increase in Assets:

7.88%

Start Date: 01/27/2026

|

|

Lot 20 Montigo, Santa Rosa Beach FL 32459

|

Lot 20 Montigo, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,800,000

Land Cost:

-

$630,000

Construction Costs:

Projected Equity Gain:

$1,873,169

ROI:

97.22%

Projected Increase in Assets:

7.49%

Start Date: 01/27/2026

|

|

Lot 3 30A, Santa Rosa Beach FL 32459

|

Lot 3 30A, Santa Rosa Beach FL 32459

Projected Appraisal:

$4,400,000

Land Cost:

-

$750,000

Construction Costs:

-

$1,390,000

Projected Equity Gain:

$2,260,000

ROI:

105.61%

Projected Increase in Assets:

8.67%

Start Date: 02/10/2026

|

|

Lot 24 Elm, Santa Rosa Beach FL 32459

|

Lot 24 Elm, Santa Rosa Beach FL 32459

Projected Appraisal:

$3,500,000

Land Cost:

-

$550,000

Construction Costs:

-

$1,300,000

Projected Equity Gain:

$1,650,000

ROI:

89.19%

Projected Increase in Assets:

6.90%

Start Date: 04/08/2026

|

| Projected Average |

Projected Appraisal: $3,708,333

Land: - $579,167

Construction:

- $1,335,471 Equity Gain: $1,793,695

ROI:93.68%

Projected Increase in Assets:7.31%

|

| Projected Total |

Projected Appraisal: $44,500,000

Land: - $6,950,000

Construction:

- $16,025,657 Equity Gain: $21,524,343

ROI: 93.68%

Projected Increase in Assets:87.70%

|

Equisource currently is either in development or under contract for 12 properties (with many more being considered) that are projected to produce $44,500,000 in total asset value, which represents a 93.68% projected average ROI and a 87.70% increase in total assets within the next 12 months. Stock prices will increase commensurately as each project nears completion.

Equisource FAQS

Equisource Holdings Corp, doing business as Legacy Beach Homes, is a real estate development and vacation rental company that owns and operates over $100 million in beach vacation rental properties across Florida’s Emerald Coast.

*The stated asset value is based on licensed third-party appraisals and may differ from GAAP values that are recorded at asset acquisition or build cost, not appraisal value.

Equisource operates a build-to-short-term-rental business model.

We develop vacation homes in Florida’s premier beach communities—such as Destin, Miramar Beach, and 30A—that cost approximately $1.9 million to build (including land) and are typically worth $3.4 million upon completion. This translates to a 90% ROI within 12 months… before we even begin renting the property.

These high-equity properties are added to our portfolio, where they generate tax-deferred, compounding appreciation and cash flow.

That cash flow is reinvested into additional high-ROI builds, accelerating a self-compounding growth cycle.

Our model is built on replicable business processes refined over nine years of development, construction, and hands-on rental operations.

*These ROI figures are based on historical examples and may not be representative of future outcomes. Past project performance is not indicative of future results.

Initially, Equisource acquired existing homes for use as short-term rentals. However, in 2022, we shifted exclusively to ground-up construction for several key reasons:

-

Higher Revenue Potential – Newly built homes are more attractive to renters and command premium nightly rates.

-

Lower Maintenance Costs – New construction minimizes repairs and upkeep, improving operating margins.

-

Significant Equity Creation – Most importantly, we generate an average of $1.6 million in equity per new build… before we even begin renting the property.

Even in the highly unlikely event a property were never rented, the equity created during the build provides approximately 13 years of operating runway on each property’s fixed expenses—making it exceptionally difficult for a project to fail.

This strategic shift to new construction was the accelerant behind our rapid asset growth beginning in 2022.

*While this equity cushion has supported most projects historically, there are no guarantees.

Since 2017, Equisource has grown its portfolio from $1.2 million to over $108 million in assets, and increased annual recurring rental revenue from $29,000 to over $5.6 million by 2024.

This level of growth would have qualified us for the Inc. 5000 list of fastest-growing private companies in America every year since 2001.

Moreover, our asset growth—expected to be the primary driver of our stock price—has consistently outperformed the Dow Jones and the S&P 500 every year of our 9-year history.

We are targeting $212 million in assets and over $13 million in revenue by 2027.

*Historical performance does not guarantee future performance. Forward-looking targets are based on current assumptions.

Todd Knight – Founder & Chief Executive Officer

Todd Knight is the Founder and CEO of Equisource Holdings Corp., doing business as Legacy Beach Homes. At 55 years old, he brings over three decades of real estate, finance, and operational experience.

Todd began his real estate career at age 16, managing rental properties for his father’s company, and purchased his first investment property—a 32-unit apartment complex—by age 22. Before founding Equisource, he acquired, renovated, and sold hundreds of residential properties, gaining deep expertise in construction, asset turnaround, and value creation. He later owned and operated a nationwide mortgage company that originated thousands of loans, providing him with extensive knowledge of lending structures and capital markets.

Since founding Equisource, Todd has led the development of over 23 ground-up, high-end short-term rental properties since 2022 across Destin, Miramar Beach, and Santa Rosa Beach, Florida. These projects average $1.6 million in equity gains per build, contributing to a portfolio now valued at over $100 million.

Todd studied Entrepreneurship at Johnson & Wales University, where he was a finalist in Venture Magazine’s Collegiate Entrepreneurship Competition. He holds a Florida real estate license, a multi-unit vacation rental license, and is a member of the Vacation Rental Management Association (VRMA), the National Association of Realtors (NAR), and qualified for Mensa.

He leads all strategic and financial planning for the company; maintains a personal credit score over 800 and is the personal guarantor on the $70 million in company mortgage debt.

An avid traveler, Todd has visited all seven continents—including Antarctica—and brings a global perspective to the design and guest experience that defines Legacy Beach Homes.

Christian Knight – Managing Director

Christian Knight has been with Equisource full-time for the past four years. He began by assisting with renovations, guest services, and property maintenance, and was promoted as he developed key operational and administrative capabilities.

He now oversees major aspects of real estate development, property management, and company administration—including licensing, guest services, vendor relations, and frontline team management.

Christian holds a bachelor’s degree in Business Administration from Columbus State University and a Florida real estate license.

Ethan Knight – Operations Director

Ethan Knight has been a full-time team member for over four years. He started with hands-on roles in maintenance, renovations, and guest services before advancing into operations and technology.

He now oversees the day-to-day operations of the rental portfolio and manages the company’s technology infrastructure, coordinating with offshore teams to maintain booking platforms, backend systems, and automation tools. He also supervises payables, bookkeeping, and CPA coordination.

Ethan holds a Florida real estate license and is nearing completion of his bachelor’s degree in Business Administration from Florida State University.

Lorrie Hicks – New Construction & Design Director

Lorrie Hicks has been a vital part of Equisource since 2017. She holds a Bachelor of Science in Interior Design from Florida State University, a program accredited by both CIDA and NASAD, and prepares graduates for NCIDQ certification.

Lorrie leads all design and execution across the company’s development projects, overseeing interior architecture, finish selections, procurement, contractor and vendor coordination, project scheduling, and FF&E installations.

Her leadership ensures each property is professionally designed, operationally efficient, and brand-consistent across the Equisource portfolio.

This is a private placement conducted under Regulation D, Rule 506(c).

We are offering up to 7,000,000 shares at $10.00 per share, for a maximum offering amount of $70,000,000.

We’re raising $70 million to retire existing debt, which will unlock substantial free cash flow. That capital will be reinvested into high-ROI new construction projects that generate both appreciation and recurring cash flow—fueling our compounding growth model.

Over the past nine years, we’ve built a repeatable, scalable business process that consistently produces equity gains and cash flow. By transitioning to an equity-based capital model, we believe we can accelerate our growth rate and scale more efficiently than ever before.

Shares are priced at $10 each, based on a discount from our net asset valuation—which reflects real estate equity based on licensed, third-party appraisals, not speculative market premiums.

As outlined in the Vacation Rental Asset Value section, our post-money asset value is $105,617,100, excluding an additional $13,000,000 in net asset value from completed construction expected by year-end 2025. This brings our projected total post-money net asset value to $118,617,100 by the end of 2025.

With 3,000,000 founder shares and 7,000,000 new shares issued through this offering, the imputed net asset value per share is $11.86.

That means our $10 share price represents a 15.7% discount to projected 2025 year-end NAV—not including the typical appreciation our properties experience over time.

We’re offering this early round at a meaningful discount to give early investors immediate, built-in equity.

Future rounds are expected to be priced significantly higher.

*NAV calculations in the above text incorporate post‑money debt retirement and are based on licensed appraisals.

No. This offering is being conducted under Regulation D, Rule 506(c), which limits participation strictly to accredited investors.

To qualify as an accredited investor, an individual must generally have annual income of at least $200,000 (or $300,000 together with a spouse) for the last two years with the expectation of the same this year, or a net worth exceeding $1 million (excluding the value of the primary residence).

Entities may also qualify if they meet certain asset or ownership thresholds.

Because this is a private placement under Regulation D, Rule 506(c), the shares are restricted securities. That means in most cases, investors must hold their shares for at least 12 months before resale.

We do, however, expect to routinely offer share repurchase programs (buybacks) at management’s discretion, providing investors with an additional path to liquidity prior to any public listing.

Our long-term intention is to seek a public listing on the OTCQB market in 2026 under the ticker symbol VACAY. If successful, this would provide a secondary market where shares could be traded through most major brokerages, such as E*TRADE, Fidelity, Charles Schwab, TD Ameritrade, Vanguard, and bank-affiliated platforms like Wells Fargo, Chase, and Citibank.

*Ttrade execution, share price, and spread depend on broker-dealer volume and market demand.

We do plan to issue future rounds after the pre-IPO shares from this Regulation A offering are listed on the OTCQB. These rounds are intended to fund high-ROI construction projects, which historically yield an average 89% return within the first year.

Importantly, we expect these future rounds to be offered at a significantly higher share price than the current $10 offering.

While any new issuance introduces some dilution, the equity created by deploying those funds into new builds is expected to increase the net asset value (NAV) per share—even on a fully diluted basis. In other words, future rounds are structured to increase, not erode, shareholder value.

It’s also worth noting that CEO Todd Knight will retain 3,000,000 founder shares post-money, meaning his interests remain fully aligned with shareholders. It would be directly contrary to his own economic interest to pursue any strategy that reduces NAV per share.

The average figures from our last 20 ground-up construction projects are as follows:

| Land cost: | $718,500 |

| Construction cost: | $1,080,128 |

| Appraisal Value: | $3,418,250 |

| Average Gain Per Project: | $1,619,622 |

While this gain doesn’t appear as traditional “income” on our income statement, it represents real, realized value creation for both the company and its shareholders.

We refer to this as construction-driven equity—and it is the cornerstone of our business model. This equity not only strengthens our balance sheet, but also powers future cash flow through rentals, refinancing, or reinvestment into additional high-ROI projects.

Our rental properties generate consistent recurring income in Florida’s high-demand beach communities. While rental revenue accounts for approximately 20% of our overall business model, it provides meaningful cash flow that supports our ongoing reinvestment into new construction.

A typical income and expense breakdown for our rental operations, based on gross rental income after rent stabilization, is as follows:

| Cleaning, turnover, and supplies: | 11.1% |

| Insurance: | 7.9% |

| Utilities (electricity, gas, water, internet): | 4.4% |

| Maintenance and repairs: | 4.8% |

| Misc. operating expenses/OTA fees: | 4.3% |

| Property taxes: | 4.1% |

| Total Expenses: | 36.6% |

| Profit Margin: | 63.4% |

This analysis excludes interest expense, as we are using the proceeds from this offering to pay off $70 million in debt, thereby eliminating future interest costs and significantly increasing net cash flow.

After expenses, the net cash flow margin on rent-stabilized properties ranges from 60–70%.

While rentals provide reliable recurring income, rental income is not our primary driver of value; it serves as a cash flow engine to reinvest into high-ROI construction projects, which generate substantially greater returns.

Most short-term rental property management companies charge between 15% and 25% of gross revenue solely for property management services.

At Equisource, all senior management—Todd Knight, Ethan Knight, and Christian Knight—have their total combined compensation capped at 15% of gross rental revenue.

This single percentage covers not only full property management, but also acquisition, development, oversight, and company-wide operations.

This structure ensures that:

-

Management costs remain well below industry averages, and

-

Executive incentives are fully aligned with shareholders.

Because management compensation is tied to performance—not salaries or bonuses—the company’s management (which are the largest shareholders) is primarily focused on growing net asset value, just like our investors.

Our current rent-to-value ratio may appear artificially low due to the rapid pace of our growth. In 2024 alone, we completed construction on 14 new properties, many of which are still in their rent stabilization phase.

These homes are typically 8+ bedrooms and designed for large group and multi-family vacations, which require significant advance planning. As a result, the average booking window is 6 to 12 months, meaning that it can take up to a year for rental income to fully stabilize.

Once stabilized, our designer-furnished, newly built homes consistently produce above-market rent-to-value ratios, especially when compared to older properties.

In brief, based on our historic rental average if we paused portfolio growth for approximately one year, our rent-to-value ratio would likely surpass our market—but doing so would come at the expense of our higher-margin new construction, which is the key driver of our long-term compounding growth strategy.

Equisource is built on proven systems and a replicable business model. The successful completion of our $70 million capital raise will dramatically improve margins, creating a powerful opportunity to accelerate our growth trajectory.

From 2017 to 2020, we grew our asset base from 1 million to over 10 million—a 10x increase in just four years.

From 2020 to 2024, we grew our asset base from $10 million to over $100 million—another 10x increase in just four years.

By using the margin unlocked from this raise, we believe we’re well-positioned to deliver our next 10x growth cycle.

*Forward-looking statements about future growth are subject to significant uncertainty, including market conditions and capital availability.

At this time, we do not pay dividends. Instead, we are reinvesting cash flow into new construction projects that generate an average 89% return within 12 months, followed by substantial long-term cash flow thereafter.

We believe we can deliver significantly stronger value to investors by compounding equity through our proven, replicable development model—rather than distributing lower-margin rental income.

This strategy prioritizes rapid asset growth which we believe will provide a significantly better return to the shareholder than dividends.

Equisource is a 9-year-old company with a strong performance record and over $100 million in coastal real estate assets.

- Coastal real estate (which has a supply that can never be increased) makes up less than 1% of the U.S. continental landmass.

- The U.S. population has grown nearly every year since the country’s founding.

- Throughout history, the ocean has consistently drawn people.

Although all investments have risk, this combination of fixed supply and increasing demand makes it highly unlikely that coastal real estate—the primary driver of our stock value—would ever lose all of its value.

Equisource’s offering provides the security of real estate with the liquidity of stock.

*All investments carry risk. There is no guarantee of perpetual value retention.

Our properties are covered by comprehensive hurricane insurance, which reimburses for replacement costs, as well as rent loss insurance, which covers any lost income during the rebuild period. As a result, there is typically no financial loss in the event of a storm.

In some cases, a rebuild can actually result in substantial equity creation.

For example:

Our property at 108 Pelican has an appraised value of $2,100,000, a replacement cost of $850,000, and a mortgage balance of $1,490,000.

If it were destroyed in a hurricane, insurance would cover the $850,000 replacement cost. By adding just $500,000 in capital for a total of $1,350,000 in construction costs, we could rebuild the home as a $4,000,000 property.

In doing so, our net asset value would rise from $610,000 to $2,510,000—a $1.9 million increase in equity—with only a $500,000 additional investment by Equisource.

While we never hope for a disaster, rebuilding after a disaster will often create the opportunity to increase shareholder value per share.

*Insurance coverage is subject to limitations, exclusions, caps, deductibles, and potential claim delays. Rebuild-to-higher-value outcomes are not guaranteed.

Many areas across the country are imposing stricter regulations—or even outright bans—on short-term rentals (STRs).

However, the Emerald Coast of Florida—where all of Equisource’s properties are currently located—offers a uniquely supportive regulatory environment for STRs. To preserve the region’s iconic coastal views, local governments enforce strict building height restrictions, typically limiting structures to four stories or fewer. As a result, over 90% of accommodations in the area are vacation rentals rather than hotels, making STRs the economic engine of the local tourism economy.

Unlike many destinations facing mounting opposition, the Emerald Coast embraces vacation rentals, with STR-friendly regulations designed to support—not suppress—their role in regional tourism.

This combination of regulatory stability and sustained demand makes the Emerald Coast one of the most investor-friendly short-term rental markets in the U.S.

As we consider expansion into new regions, we carefully evaluate each market’s STR regulatory climate, ensuring we operate only in jurisdictions aligned with long-term short-term rental investment.

*STR regulations are subject to change.

At Equisource, we are long-term hold investors focused on building and retaining high-quality, income-producing real estate. Because we are not reliant on short-term asset sales, temporary market dips do not pose a significant risk to our strategy.

In fact, market corrections often create opportunistic buying environments, allowing us to acquire land or construction at better prices—which can further improve project-level returns.

Coastal real estate in Florida has consistently appreciated over time. Given the region’s limited supply, ongoing population growth, and sustained tourism demand, we feel confident that long-term appreciation will continue

*This response contains forward-looking statements that involve risks and uncertainties. Past performance is not a guarantee of future results, and market conditions may change.

There is currently some geographical concentration risk. However, Florida’s Emerald Coast partially offsets this with exceptional fundamentals, including: year-round tourism demand, supportive short-term rental regulations, limited hotel competition due to strict height restrictions, and strong historical property appreciation.

However, with the unlocked margins from this capital raise, we now have the ability to outsource property management in other markets, allowing us to expand into new regions without the logistical constraints of in-house management.

This evolution in our model will help us mitigate geographic concentration risk and scale across multiple markets in the near future.

Equisource has taken proactive steps to ensure long-term operational continuity. Both Christian Knight and Ethan Knight have been groomed for succession, having risen through the organization and developed a deep, hands-on understanding of all operational functions. Today, they each oversee key areas of the business and are responsible for its day-to-day execution.

Additionally, we are in the process of establishing an independent board of directors, which will enhance oversight and provide additional strategic continuity.

In the event that Todd Knight were to become incapacitated, the company is well-positioned to continue executing its business plan without disruption.

Yes — shareholders who invest $50,000 or more receive complimentary stays of up to seven consecutive nights at any of our properties. It’s equity with perks.

Stays must be booked no more than two weeks in advance and are subject to availability. For property details and availability, visit: https://legacybeachhomes.com

You can invest securely online here or by clicking the “Invest Now” button on the top right corner of this web page.

Additional Resources

Verify Todd Knight’s current Florida Real Estate license history (9 years, 0 complaints), which requires a full FBI background investigation here:

https://www.myfloridalicense.com/LicenseDetail.asp?SID=&id=3261476C536CA74D9D833E4DBDBA9757=

All real estate is vested in the name Equisource Holdings Corp. Verify Equisource Holdings Corp’s good standing for the last 9 years here:

Search on the name “Equisource” here to verify all real estate owned and mortgages owed in Walton County:

https://orsearch.clerkofcourts.co.walton.fl.us/

By default, this county’s public website only returns the first 100 records. Change the number of records setting to show the first 2,000 records to view all Equisource’s records, including our most recent.

Search on the name “Equisource” here to verify all real estate owned and mortgages owed in Okaloosa County :

https://clerkapps.okaloosaclerk.com/LandmarkWeb/Home/Index

By default, this county’s public website only returns the first 100 records. Change the number of records setting to show the first 2,000 records to view all Equisource’s records, including our most recent.

Search on the name “Equisource” here to verify that we have never been sued in Okaloosa County:

Search on the name “Equisource” here to verify that we have never been sued (with the exception of HOA-wide disputes) in Walton County:

Our Area

There’s a reason Good Morning America recognized Destin, FL as “One of the Most Beautiful Places in America” and why Dr. Beach named Florida’s Scenic Highway 30A “America’s Best Beach.”

Unlike many coastal areas, the Emerald Coast’s waters remain crystal clear due to the absence of river inflows, preventing sediment from clouding the Gulf. This exceptional clarity, combined with the region’s pure ground quartz sand—often called “sugar sand”—creates a stunning light refraction effect,

Take a moment to enjoy the stunning photos of this incredible destination!

This website contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are based on current expectations, estimates, and projections about our business and markets, and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied in such statements. Words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “targets,” “projects,” and similar expressions are intended to identify forward-looking statements. These statements speak only as of the date made and should not be relied upon as guarantees of future performance. Equisource Holdings Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future developments, or otherwise, except as required by law. Investors are encouraged to review the Company’s offering circular and risk factors before making any investment decisions.